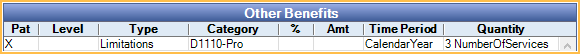

Other Benefits

In the Edit Benefits window, at the bottom, is the Other Benefits grid.

Other Benefits are additional benefits or overrides added to insurance plans. For a detailed explanation of options on the Edit Benefit window, see Edit Benefits - Row View. Other Benefits are useful when setting up an incentive plan, or when overriding typical insurance percentages or amounts. Only specific scenarios listed below are known to work. Combinations not listed will display in the benefits section for informational purposes only.

Click Add, or double-click an existing benefit to edit.

1. Override a procedure or category benefit percentage for a specific patient but not everyone on the plan (e.g. incentive plans)

This may be necessary when you have an incentive plan and each family member is at a different percentage.

2. Cover a procedure at a different percentage

For example, insurance covers nitrous oxide at 80%, even though other procedures in that Insurance Category are not covered (0%).

3. Some work does not apply toward regular annual max

This may be necessary when you need to add a benefit that does not apply to the annual max. For each category you want to exclude from the annual max, create a new benefit.

Examples:

- CHIP

- Some Medicaid plans

- A plan that has a x-ray limit of $150 for the year, with everything else covered at a flat co-pay amount.

- Diagnostic, preventive, and x-rays that do not apply to the annual max.

- A specific procedure code is covered up to a set amount. Enter the procedure code with the amount it will be covered up to by insurance.

4. Each family member has a different annual maximum

For each family member, add an Other Benefit using the settings below.

5. No max for a category (e.g., preventive).

You can also set the time period as service year if appropriate. Test in the treatment plan module (e.g., add a $10000 preventive procedure and a $200 filling to make sure it behaves as expected.)

6. Set an age limitation

The age limit is through the designated age. For example, entering 16 will cover the patient until their 17th birthday.

7. There is a waiting period on a specific code

Waiting periods can be set by code from the Edit Benefits window. Individual codes can be done using the setup below. An effective date is required to be entered in the Insurance plan for the calculations to work.

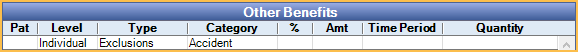

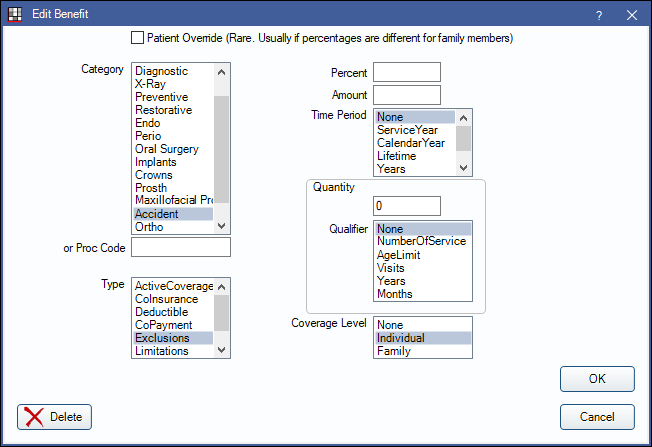

8. Certain Codes or Categories have Exclusions

Some states or municipalities allow uncovered procedures to be charged at the full UCR fee with no writeoffs. Create an Other Benefit to define which procedures or categories are subject to this Exclusion.

Define how Exclusions are billed in Preferences, or in the Insurance Plan, Other Ins Info tab.

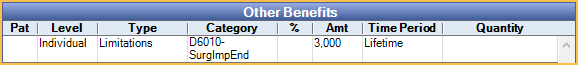

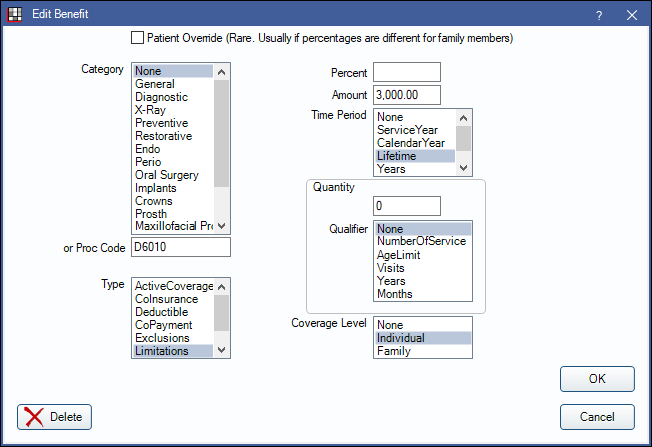

9. Lifetime Max for Code or Category

For plans that have a lifetime maximum for certain codes or categories, create an Other Benefit to define the applicable code or category, and the amount.

10. Deductible max for category or procedure

For categories or procedures that have a deductible that differs from the general annual deductible create an Other Benefit to define this amount.

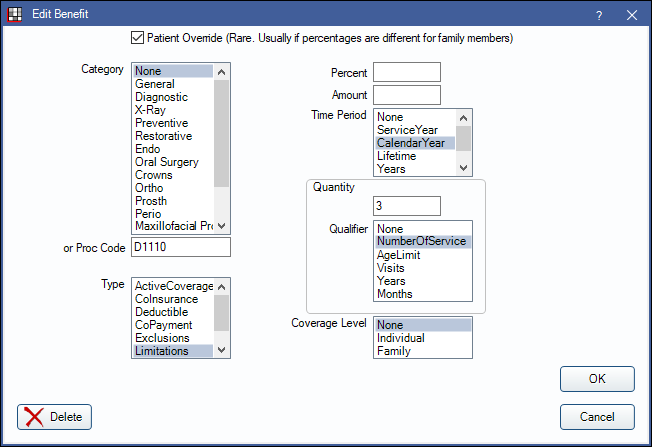

11. Override a frequency limitation for a specific patient, but not everyone on the plan.

This may be necessary for patients enrolled in special insurance programs due to higher oral health risk.

This other benefit must be set up in the following way to function properly:

- Patient Override: This box must be checked.

- or Proc Code: If using a procedure code, it must be a procedure code currently added to Frequency Limitations in Preferences. All procedure codes for the Frequency Limitation category will be considered (e.g., if D0120, all codes entered in the Exam Frequency Limitation category are considered).

- Type: Limitations

- Time Period and Qualifer: Must be the same as any plan-level Frequency Limitation (e.g., if the plan-level benefit is NumberOfServices per CalendarYear, the override must be as well).

- Coverage Level: None

12. If You have different categories

Usually this means you are in a country other than the U.S. or Canada, and thus using Row View instead of Simplified View. Enter the insurance categories in Definitions and Insurance Categories. Then assign benefit amounts. For a Canadian Time Unit benefit example, see Canada Procedure Code Time Units.