Benefits

Custom benefits can be entered on an insurance plan to calculate procedure estimates and insurance remaining estimates

In an Insurance Plan, at the lower right, is the Benefit Information.

Benefits apply to all subscribers on the plan. If different subscribers have different benefits, create different plans. If a user change benefits for a plan, all Claim Procedures ( claimprocs ) estimates will also change including those on current and sent claims. Sent claims will need to be recalculated before changes affect claim estimates.

To change or view benefits, double-click anywhere in the grid. To change benefit information, the Insurance Plan Edit security permission is required

There are two view options for the Edit Benefit window.

- Simplified View (default): This view allows quick data entry and organizes benefit information by field. See below for a description of each field.

- Row view: If Simplified View is unchecked, benefits are represented by rows. See Edit Benefits - Row View. This is useful if you don't use typical insurance categories (e.g. are in a country other than the U.S. or Canada).

Simplified View

The fields that show in Simplified View are described below. Click in a field to enter values. Leaving a box blank is different than entering a zero; blank means unknown.

Benefit Year: The renewal date used to calculate benefits and the current benefit year. It applies to all benefits in the window.

- If plan follows calendar year (starts in January; ends in December): Check this box.

- If the plan follows a service year (starts in a month other than January): Uncheck the box, then enter the two-digit month when benefits renew in the Month field (e.g. October = 10, February = 02).

Annual Max: The maximum annual amount insurance will pay in benefits per individual or family. If left blank, Insurance Remaining Calculations cannot be done.

- Individual: Enter the annual max amount for the individual.

- Family: Enter the annual max amount for the entire family. Leave blank if If there is no Family Annual Max for the plan.

General Deductible: The amount the individual or family pays out of pocket before the insurance company will begin to pay. Applies to procedures in the None or General category and resets at the start of the new service or calendar year.

- Individual: Enter the deductible amount for the individual. If the Family deductible has already been met, the individual deductible will not be applied.

- Family: Enter the deductible amount for the entire family. If the Family deductible has been met by a family member or combination of family members, individual deductibles are no longer applied. Leave blank if there is no Family Deductible for the plan.

Categories:

- Percentages: The percent covered per procedure for each category. For quick entry of the same percentage amount, enter the amount under Quick% and it will automatically populate the associated fields to its left.

- Deductibles (if different): The deductible per individual or family for a specific category, if it is different than the General Deductible. Zero indicates there is no deductible at all. If blank, the General Deductible is used. See Deductibles.

- Waiting Periods (if applicable): The number of months a patient must wait before insurance will cover a procedure. An effective date must be entered in the Insurance Plan for waiting periods to calculate.

Fluoride Through Age: Creates an age limitation for fluoride procedures. Bases estimates off codes entered in Insurance Frequencies. 0 is not a valid entry.

Sealants Through Age: Creates an age limitation for sealant procedures. Bases estimates off codes entered in Insurance Frequencies. 0 is not a valid entry.

Frequencies: Plan frequency limitations for categories. Enter a value, then click the dropdown to select the frequency. For example:

- Every # Years: Every 2 years,

i.e. one procedure covered every 2 years. Uses the patient's calendar or service year. - # Per Benefit Year: 2 per year,

i.e. two procedures every year. - Every # Months: Every 2 months,

i.e. one procedure every 2 months. - # in Last 12 Months: 2 in last 12 months,

i.e. two procedures in the last 12 months. Uses the last 12 months from today (e.g. Rolling Year, Rolling Benefits).

More: Click to add additional Benefit Frequencies. See: Frequency Limitations for more information.

For each procedure code with a frequency limitation, a row will show in the Family module, Insurance Plan area for easy reference.

Ortho: Enter orthodontic benefit information.

- Lifetime Max: The maximum orthodontic benefit. This is separate from the individual and family Annual Max above as long as the insurance category spans are set correctly. The correct setup (and default) is to have an Ortho span of D8000 to D8999 and to exclude that span from the General category.

- Percentage: The percentage per procedure that is covered. This will affect insurance estimates.

- Ortho Through Age: Used with codes that fall into Ortho insurance category span. This will affect insurance estimates. 0 is not a valid entry.

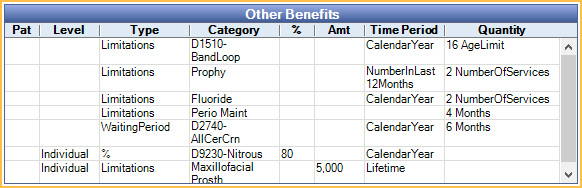

Other Benefits: Benefits that are specific to this insurance plan. Useful for incentive plans, or to override typical insurance percentages or amounts. See below for more information.

Notes: This is the same as the subscriber note on the Edit Insurance Plan window. Certain types of benefits that just affect the subscriber are not easily codified, so do not have a box. These types of benefits are just entered as subscriber notes.

Other Benefits (Benefit Types)

ActiveCoverage: Informational only. Not normally used. Used to show a patient has coverage, but without any specific information (e.g. percentage).

Percentage (CoInsurance): Percentage insurance will cover of a certain procedure or category.

Deductible: Dollar amount the individual or family must pay before insurance coverage begins.

CoPayment: Informational only. Patient portion owed for a procedure. Copayments should be entered into a copay fee schedule instead. Any copays entered into insurance benefits are non-functional. See: Fee Schedules for more information.

Exclusions: Services that are not covered by insurance. These can be procedure categories or individual codes.

Limitations: Includes multiple limitation types such as maximums frequency or age.

Waiting Period: Time period after the insurance effective date the insured must wait prior to insurance covering a benefit.

Benefit Hierarchy

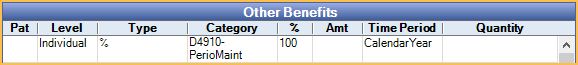

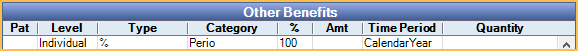

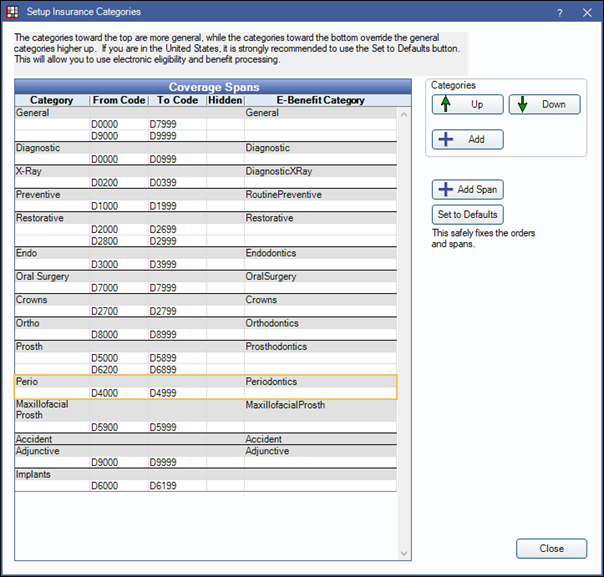

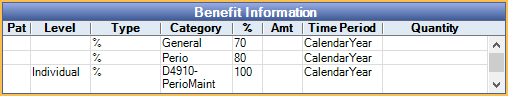

Benefits are calculated one procedure at a time. Multiple benefits can apply to a single procedure code. If some benefits are of the same type, there is a hierarchy to determine which benefit will affect insurance estimates.

1. Benefits applied to the specific procedure code.

2. Benefits applied to an Insurance Category containing the procedure code. If the procedure is included in multiple categories, benefits for categories lower in the list take higher priority.

Example:

If D4910 is in both the General and Perio categories, the Perio benefit supersedes the General benefit, because the category is more specific (lower in the Insurance Categories list). If no other benefits existed for the procedure, insurance would cover the procedure at 80% Perio rate, not the 70% General rate.

Because there is a benefit specifically for D4910, this supersedes the benefits for any category. Even though D4910 is included in the Perio and General categories, the procedure will actually be covered at 100%.