Insurance Aging Report

The Insurance Aging Report is useful to view aging broken down by insurance estimates and patient portion estimates.

In Standard Reports, in the Monthly section, click Insurance Aging Report.

Offices that want to make sure they are getting paid by insurance companies and want to follow up on older claims should use the Outstanding Insurance Claims Report instead.

This report is based on the guarantor's billing type, primary provider, and clinic. Aging is automatically recalculated when the report is generated.

- To control user access to reports, see Report Setup: Security Permissions.

- To set other report defaults, see Report Setup: Misc Settings (text wrapping, include patient number).

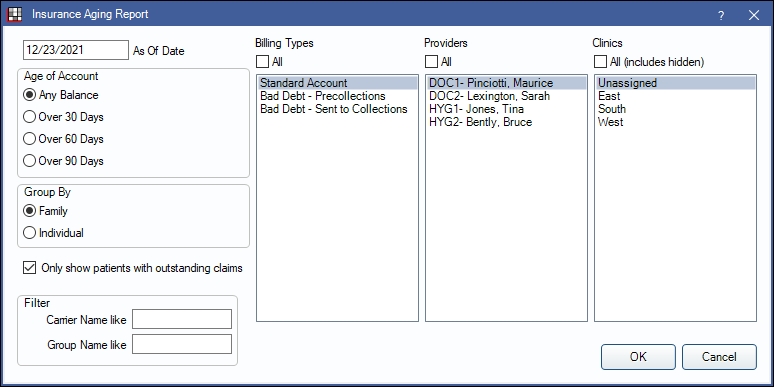

Filters

As Of Date: Enter the as of date for the report. Defaults to the date of the most recent aging calculation (usually today). If changed to an historical date, totals reflect all transactions up to the date entered except for estimated write-offs.

Age of Account: Select which patients to include based on aging balance.

- Any Balance: Include patients with any balance due.

- Over 30 Days: Include all patients with any balances that are over 30 days due.

- Over 60 Days: Include all patients with any balances that are over 60 days due.

- Over 90 Days: Include all patients with any balances that are over 90 days due.

Group By: Select how to group calculation amounts.

- Family : Group by family, listed by guarantor. Only shows guarantor and family totals, even if insurance plans differ.

- Individual: Group by individual patient.

Only show patients with outstanding claims:

- Checked: Limit report to patients with outstanding claims and enable insurance breakdown options below. Results will be grouped by both carrier name and group name.

- Unchecked: Display all patients, regardless of whether they have outstanding claims.

Filter: Insurance breakdown options. Only shows when Only show patients with outstanding claims is checked.

- Carrier Name like: Type an insurance carrier name to limit the report results.

- Group Name like: Type an insurance plan group name to limit report results.

Billing Types: Highlight the billing types to include or check All to include all billing types.

Providers: Highlight the primary providers to include or check All to include all provider, including those marked Hidden on Reportsprimary providers.

- When Group By is set to Family, filters by guarantor's primary provider. When Group By is set to individual, filters by patient's primary provider.

Clinics: Clinics: Select clinics to include in the report. Ctrl + click to select multiple clinics or check All (includes hidden) to include all clinics, including those marked hidden.

- When Group By is set to Family, filters by the guarantor's assigned clinic. When Group By is set to individual, filters by the patient's assigned clinic.

- If user is restricted to specific clinics, only accessible clinics will list. When checking All (includes hidden), results will include all clinics user has access to, including those marked hidden; results do not include clinics user is restricted from or patients not assigned to a clinic.

Report Preview

Click OK to generate the report. The resulting report will change depending on if Only show patients with outstanding claims is checked. Below are example reports and explanation of report columns.

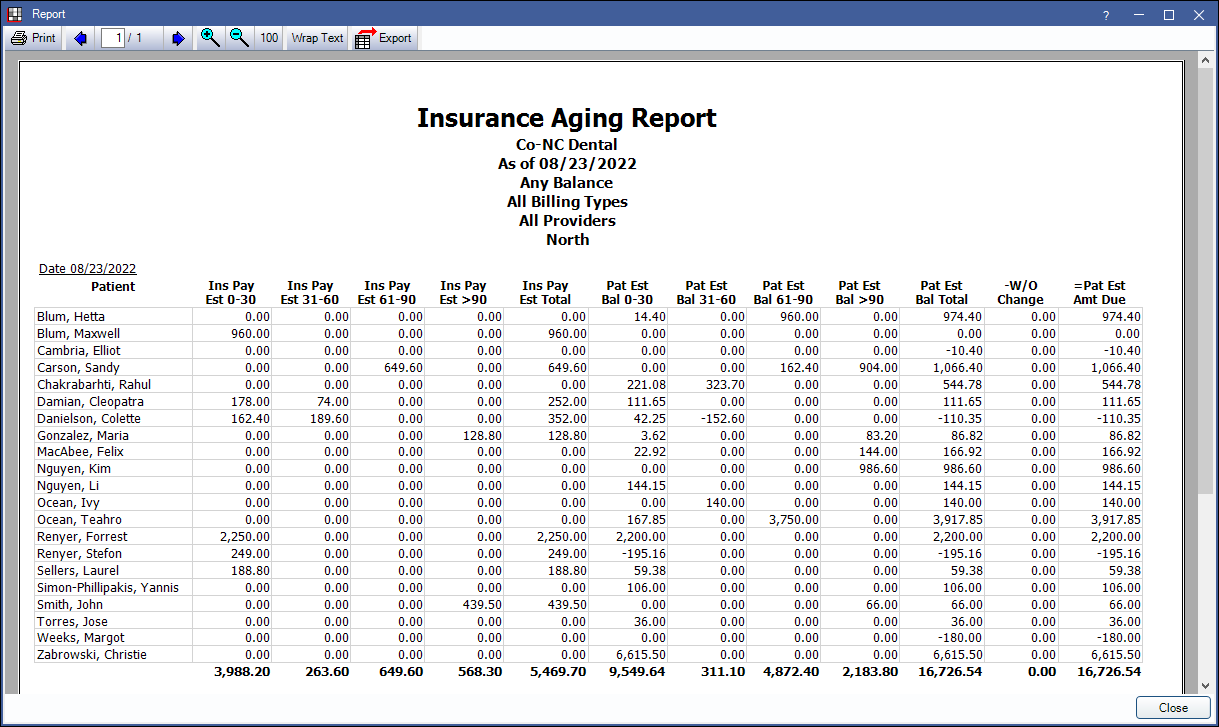

Report, run by patient, with Only show patients with outstanding claims unchecked:

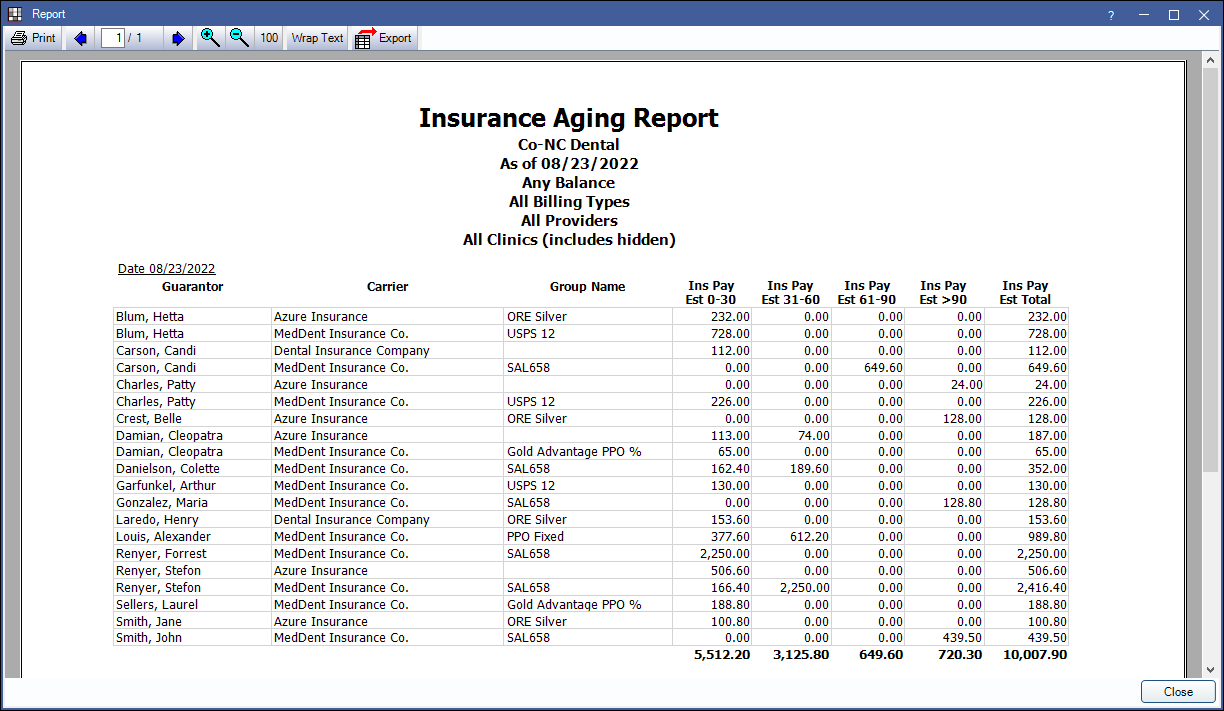

Report, run by family, with Only show patients with outstanding claims checked:

The columns will vary depending on the report criteria.

- Guarantor or Patient:

- When grouping by Family the guarantor of any families who meet filter criteria will list. Subsequent columns will be reflective of family balances.

- When grouping by Patient the name of any patient who meets filter criteria. Subsequent columns are reflective of patient balance.

- The following columns will only appear on the report when Only show patients with outstanding claims is checked:

- Carrier: Insurance carrier associated with the associated outstanding insurance estimate.

- Group Name: Group name of the the insurance plan associated to the outstanding insurance estimate.

- Ins Pay 0-30 Days: The estimated insurance balance that is 30 days past due.

- Ins Pay 31-60 Days: The estimated insurance balance that is 31-60 days past due.

- Ins Pay 61-90 Days: The estimated insurance balance that is 61-90 days past due.

- Ins Pay > 90 Days: The estimated insurance balance that is greater than 90 days past due.

- Ins Est Total: The total estimated outstanding amount owed by insurance.

- The following columns only appear when Only show patients with outstanding claims is unchecked:

- Pat Est 0-30 Days: The patient estimated balance that is 30 days past due.

- Pat Est 31-60 Days: The patient estimated balance that is 31-60 days past due.

- Pat Est 61-90 Days: The patient estimated balance that is 61-90 days past due.

- Pat Est > 90 Days: The patient estimated balance that is greater than 90 days past due.

- Pat Est Bal Total: The total patient estimated balance.

- W/O Change: The difference between the original write-off estimate and the current write-off estimate (if changed) for unreceived claims.

- Pat Est Amount Due: The total amount estimated to be owed by patient after insurance estimates and changes in write-offs. This is based on the total account balances and not only outstanding claims (i.e. Pat Est Amount Due = Total Account Balance - Ins Pay Total - Write-offs).

Report Logic

Insurance payment estimate (Ins Pay) columns are based on the Claim Snapshot and include estimated write-offs. If any change is made that affects the estimated write-off, this will be reflected in the W/O Change column only.

Patient estimated balances (Pat Est) columns are based on the Total Account Balance, this amount is not on the report, minus insurance payment estimates from the Claim Snapshot (e.g. Pat Est >90 = Total Account Balance - Ins Pay Est >90)

This report does not exclude accounts with negative balances. The aging of negative adjustments is determined by the preference, Age negative adjustments by adjustment date.